Hey everybody,

I wanted to go into further detail about the brief conversation I had with Xavier and Deanna on the Millionaire Mindsets podcast. We were talking about car payments and investing the money in index funds instead. If you haven’t heard my podcast episode with them you can check it out HERE. If you want more information on what an Index Fund is and how to invest in them, check out my book FinancialStarterKit.com.

In our initial conversation, I was explaining to them how the average car payment is now $500/mo and how people can get ahead by investing what they were paying on their car note once it is paid off. (If your car payment is less than $500/mo keep reading, this applies to you as well). Personally, I am all about delayed gratification when it comes to commuter cars and cars in general. A commuter car is a vehicle that is used primarily to commute to work. This vehicle sits in your company’s parking lot for 40+ hours a week and you drive it for 5 - 20 hours a week. I don’t think people realize how much time their vehicle is just parked every week. Take a second to think about how much time your car is parked throughout the week, probably longer than you thought, huh?

I prefer to own commuter cars because once they are paid off you can invest what you were previously paying for a car payment. If you know me then you know that I am still driving a 2003 Honda LOL. You don’t have to drive a car as old as mine, but you can definitely make a huge financial difference just by holding on to a commuter car for longer than 5 years. With the technology in cars nowadays cars made after 2015 have pretty much every feature that someone would want in a car. Nice design, Bluetooth, and comfort you are good to go.

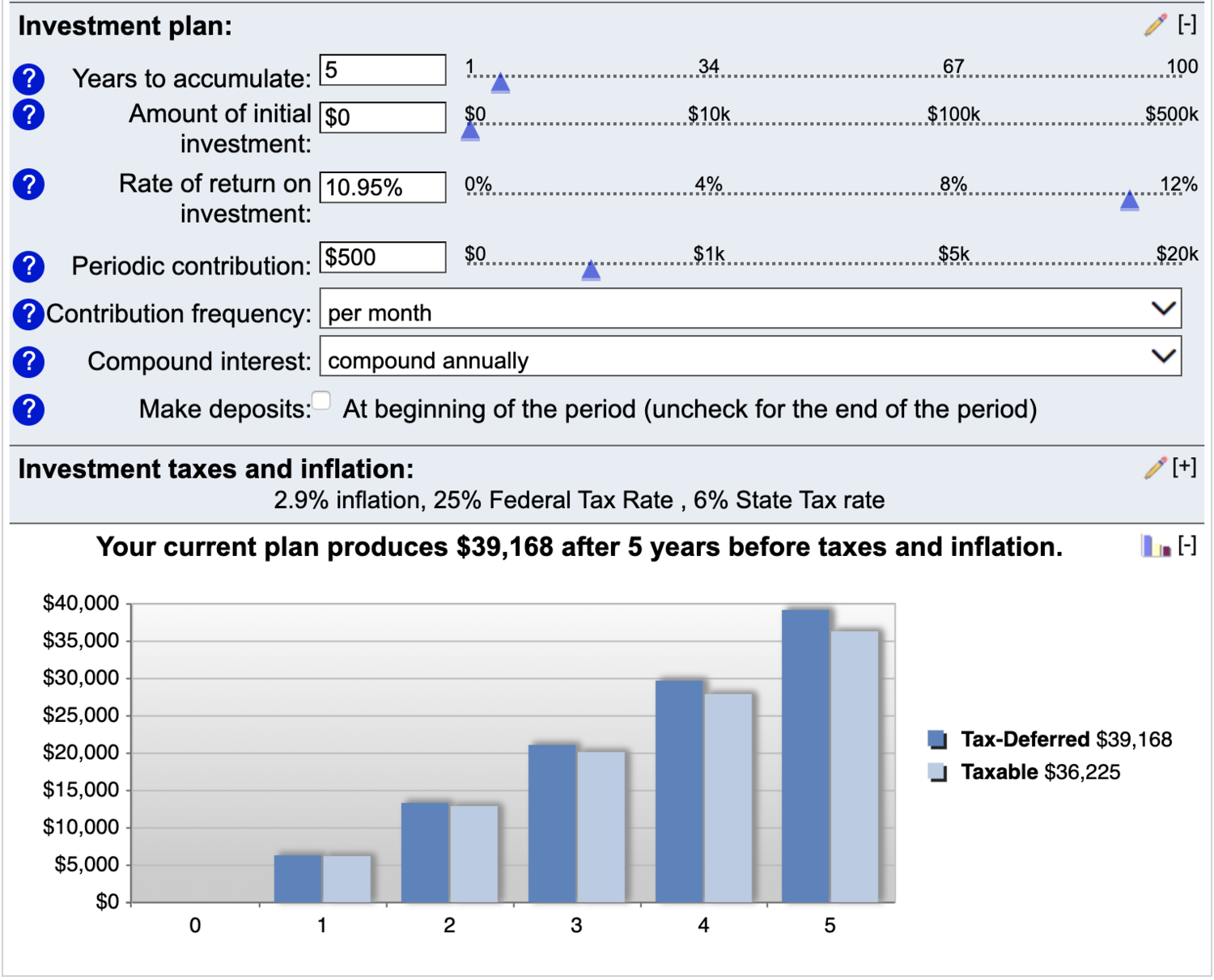

Let’s say that you keep a car that you have paid off for a total of 10 years. You would have 5 years of no car payments. During those 5 years of being car note free, you take your $500/mo (or take your actual car payment) and invest it into an index fund that tracks the S&P 500. For this example, we will use Vanguard’s Total Stock Market Index Fund (VTSAX). VTSAX has a 10.95% 5-year average return and a 13.42% 10-year average return according to Yahoo Finance. Do your own research on other Index Funds that you may want to invest in.

After 5 years of investing your car payment, you would have $39,168.

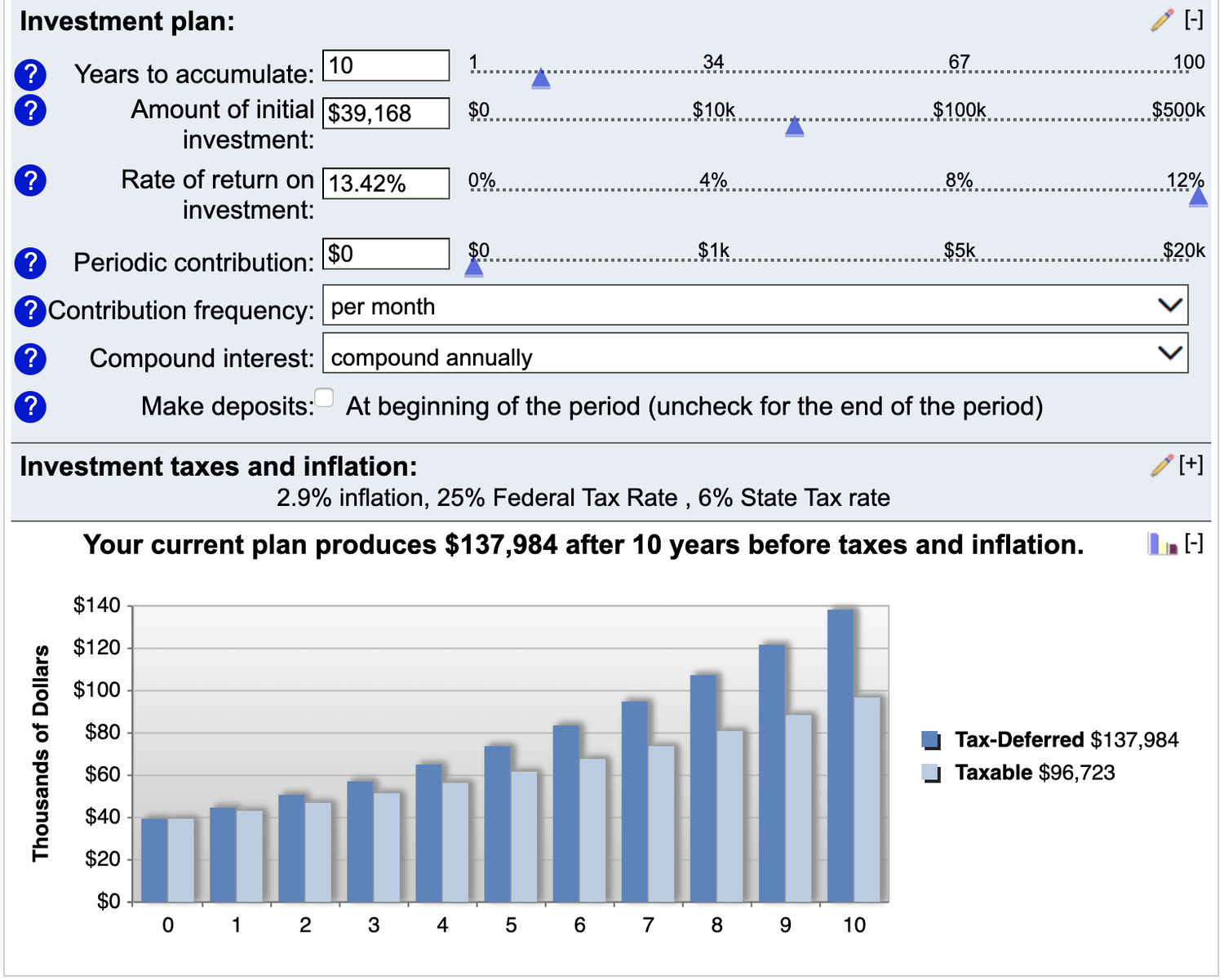

Let’s say you never invest another dollar into the index fund and you decide to let your money continue to grow. If you allow your money to grow for another 10 years you will have $137,984.

This is the power of compound interest at work. 5 years of no car payment and investing the money instead can yield you more than ONE HUNDRED THOUSAND DOLLARS. This is a pretty simple way to get ahead through delayed gratification and being disciplined enough to invest your money. So think long and hard before buying a brand new car, you may be giving up a $100,000+ investment opportunity.

If you want to play around with these numbers you can visit Bankrate’s website. A 7% annual interest rate is a conservative number that you can use, and any Index Fund you decide to invest in should meet this threshold.

If you want more information on Index Funds and other investment options you can check out my book Financial Starter Kit.

If you want to see other examples of Index Funds check out my thread HERE.

Note: This is not specific investment advice. Market conditions, taxes, and inflation may affect the numbers shown.

Download my Free M1 Investing Guide