Currently we are in the midst of a pandemic. If you or someone you know is having issues with debt and feel like you cannot keep up, I urge you to look at debt consolidation options to make your monthly payments more manageable during this time.

What is debt consolidation?

Debt consolidation is when you take out one loan to transfer high interest rate debt from credit cards, personal loans, or student loans into a single loan with a lower interest rate. Typically, after utilizing a debt consolidation loan you end up with lower payments due to the lower interest rate and a loan term between 36 – 84 months (3 years to 7 years) from 6.99% to 24.99% APR.

For example, let's say you owe $10,000 across two (2) credit cards, $3,000 at 20% APR on one card and $2,500 at 23% APR on another credit card. You also have one (1) personal loan for $4,5000 at 15% APR. You would apply for a debt consolidation loan of $10,000 depending on your credit you will end up with a lower interest rate.

Now you have rolled the $10,000 worth of debt into one single loan which is easier to manage. You will have a lower monthly payment and depending on your credit your overall interest rate will be lower as well.

Right now it is important to do what you need to do to keep your credit in good standing. Avoid late payments and avoid debt being sent to collection agencies if possible. Make sure that you do not add more debt to the previous cards that you transferred the debt from. This will create a debt cycle that is very hard to get out of.

Requirements to obtain a debt consolidation loan

- Complete the application with your social security number

- Hard credit pull

- Work income (they will ask for employer verification)

Where to apply?

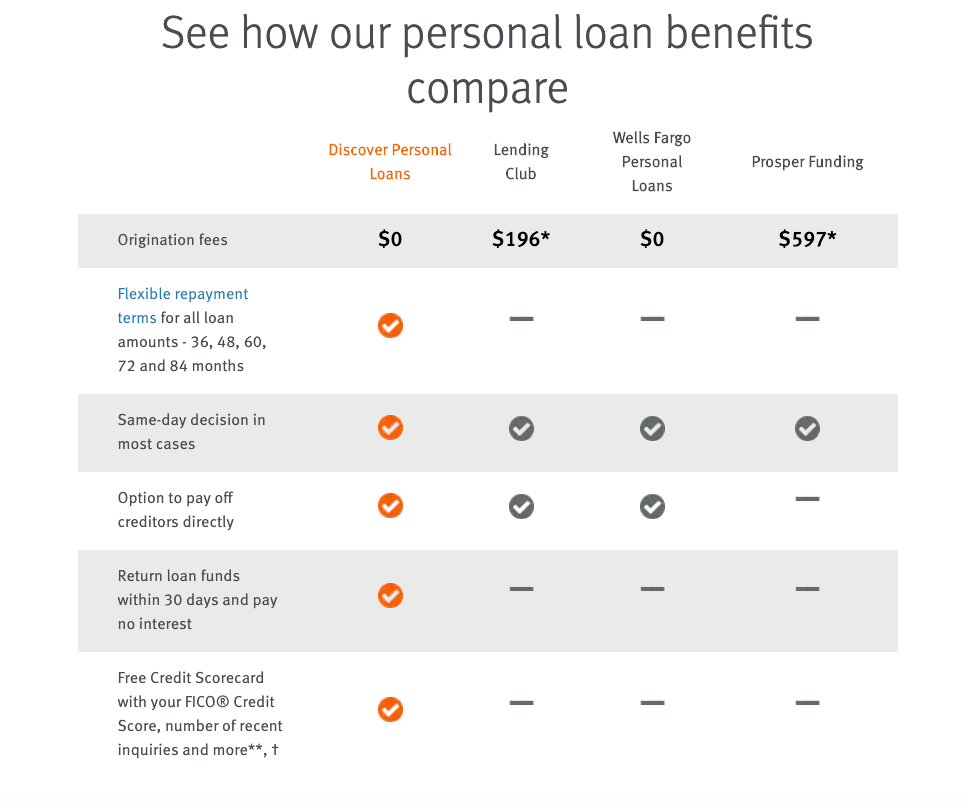

I recommend that you apply for a debt consolidation loan with Discover at discoverpersonalloans.com . Discover has no loan origination fees, lower interest rates no early pay off fees and free FICO credit score monitoring compared to other debt consolidation companies.

Thanks for reading. If you know someone who needs this information, feel free to send this blog to them. If you are interested in learning more about credit and personal finance check out my best selling book called Financial Starter Kit.